Our flagship wealth planning course teaches you how to secure your financial future with certainty. Ancient texts provide evidence that two of the earliest civilizations in human history, the Babylonians and Sumerians, first used compound interest about 4400 years ago. However, their application of compound interest differed significantly from the methods used widely today. In their application, 20% of the principal amount was accumulated until the interest equaled the principal, and they would then add it to the principal.

What is the effective annual interest rate?

We’ll use a 20 yearinvestment term at a 10% annual interest rate, to keep things simple. As you compare the compound interest line tothose for standard interest and no interest at all, you can see how compounding boosts the investment value. This compounding effect causes investments to grow fasterover time, much like a snowball gaining size as it rolls downhill. Assuming that the interest rate is equal to 4% and it is compounded yearly, find the number of years after which the initial balance will double.

How does the compound interest rate calculator work?

Use this calculator to easily calculate the compound interest and the total future value of a deposit based on an initial principal. Inspired by his own need to calculate long-term investment returns and simplify the process for others, Tibor created this tool. It’s designed to help users plan their financial future, whether for retirement, saving for a home, or understanding the potential growth of their investments. To simplify this, let’s say you owe $1,000 at the start of your billing cycle and you don’t make any additional charges to the card and don’t pay anything off, either. This means that the daily balance for each day in your billing cycle — let’s say it’s 31 days — would be $1,000.

Principal (P) using I

Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors. We are not to be held responsible for any control system mason gain formula resulting damages from proper or improper use of the service. When the returns you earn are invested in the market, those returns compound over time in the same way that interest compounds.

- Or,you may be considering retirement and wondering how long your money might last with regular withdrawals.

- In this case, since the daily balance was $1,000 for each day, the total daily balances would simply be $31,000.

- Using shorter compounding periods in our compound interest calculator will easily show you how big that effect is.

- This process is repeated each month if you don’t pay off your balance in full.

Just enter your beginning balance, the regular deposit amount at any specified interval, the interest rate, compounding interval, and the number of years you expect to allow your investment to grow. For example, $100 with a fixed rate of return of 8% will take approximately nine (72 / 8) years to grow to $200. Bear in mind that “8” denotes 8%, and users should avoid converting it to decimal form. Also, remember that the Rule of 72 is not an accurate calculation. Therefore, the more often the interest is added to (capitalized on) the principal amount, the faster your balance grows. If you include regular deposits or withdrawals in your calculation, we switch to provide you with a Time-Weighted Return (TWR) figure.

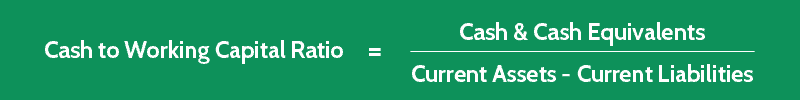

The most comfortable way to figure it out is using the APY calculator, which estimates the EAR from the interest rate and compounding frequency. The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. It’s quite complex because it takes into consideration not only the annual interest rate and the number of years but also the number of times the interest is compounded per year. Most financial advisors will tell you that compound frequency is the number of compounding periods in a year. In other words, compounding frequency is the time period after which the interest will be calculated on top of the initial amount.

I’ve received a lot of requests over the years to provide a formula for compound interest with monthly contributions. Future Value – The value of your https://www.business-accounting.net/additional-accounting-student-resources/ account, including interest earned, after the number of years to grow. When it comes to retirement planning, there are only 4 paths you can choose.

Now that we’ve looked at how to use the formula for calculations in Excel, let’s go through a step-by-step example to demonstrate how to make a manualcalculation using the formula… By using the Compound Interest Calculator, you can compare two completely different investments. However, https://www.accountingcoaching.online/ it is important to understand the effects of changing just one variable. Compound interest has dramatic positive effects on savings and investments. Interest is the cost of using borrowed money, or more specifically, the amount a lender receives for advancing money to a borrower.

In finance, the interest rate is defined as the amount charged by a lender to a borrower for the use of an asset. So, for the borrower, the interest rate is the cost of the debt, while for the lender, it is the rate of return. Generally speaking, if you have a good credit score or excellent credit score, you’re going to qualify for a lower interest rate. Next, multiply that amount by 31 since that’s the number of days in the billing cycle.

Instead, you can use our free compound interest calculator, found at the top of this page for your convenience. The way compound interest works are that the interest is added to the principal balance for each term. Compound interest might sound confusing if you’re never heard of it before. Our investment balance after 10 years therefore works out at $20,720.91. I think it’s worth taking a moment to mention the monetary gain that interest compounding can offer.

A compound interest calculator can help individuals estimate how much they need to save regularly to reach their retirement goals and ensure a comfortable financial future. Your initial investement of plus your investment of at an annualized interest rate of will be worth after when compounded . So, in about 24 years, your initial investment will have doubled. If you’rereceiving 6% then your money will double in about 12 years. See how your savings and investment account balances can grow with the magic of compound interest.

Using shorter compounding periods in our compound interest calculator will easily show you how big that effect is. You get the best effective rate when you have daily compounding (also called continuous compounding) and slightly worse with monthly or yearly compounding. The interest rates of savings accounts and Certificate of Deposits (CD) tend to compound annually.